There are currently some hilarious newspaper cartoons about extinction, usually featuring the Conservative Party. But for some time I’ve also be reading serious articles about cash machines heading for extinction.

I read today that Which? is warning that free cash machines could disappear within three years. It says that 1,250 were converted to charging people about £1 to withdraw cash in March. Cash machines cost money to run. The Bank of England recently said: “The UK’s cash infrastructure costs £5bn a year to run…”

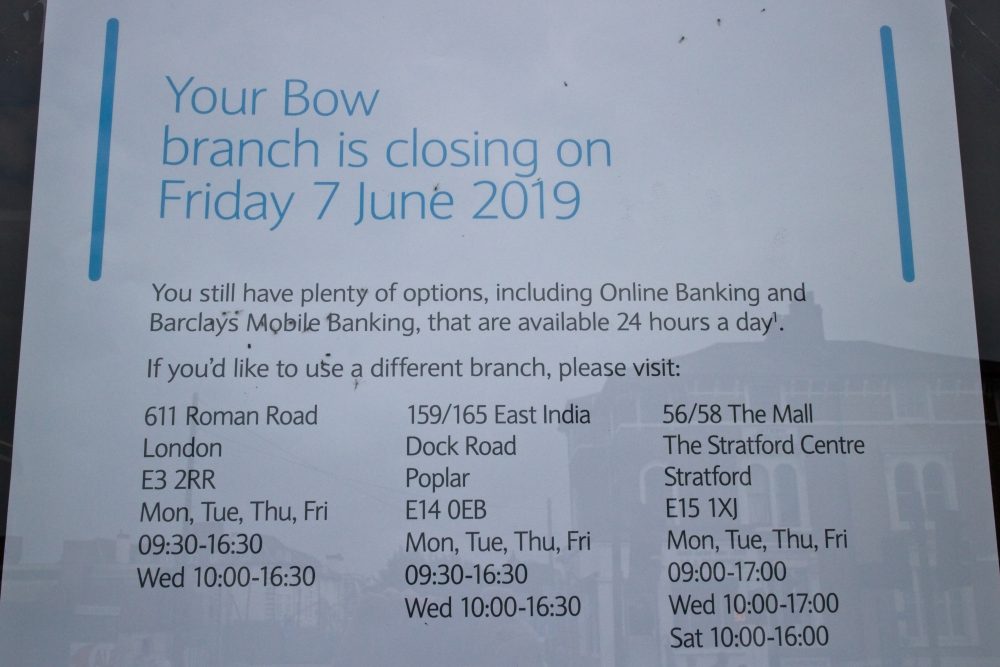

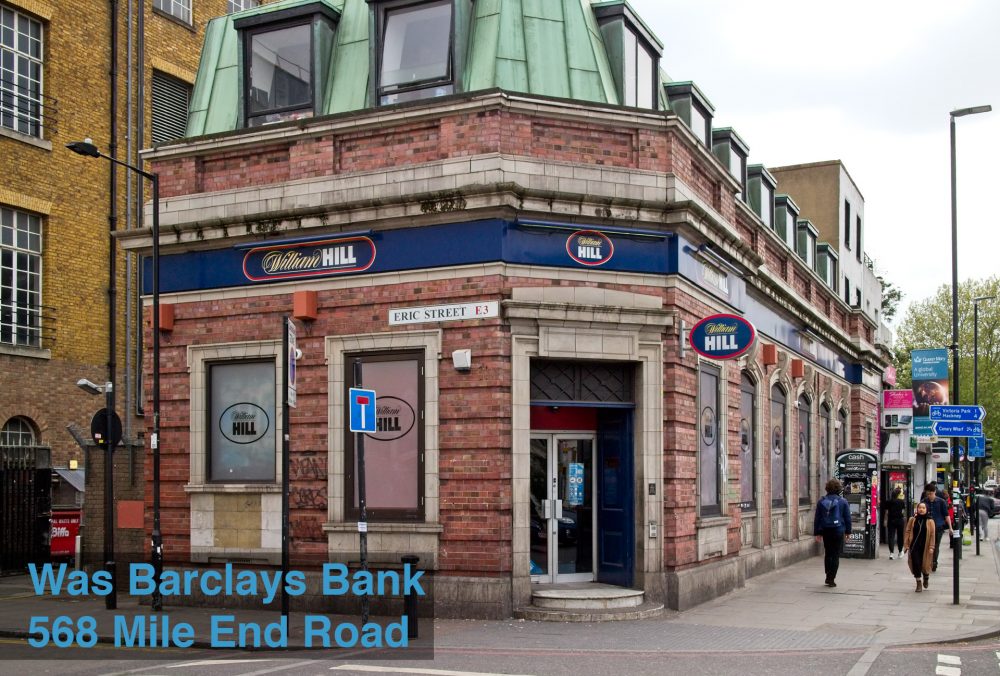

Two thirds of UK bank branches have closed in the last 30 years, and currently about 70 a month are closing. They also cost a lot of money to run. Customers no longer need to go and queue because they can do it all online faster.

Amazon started out selling books in 1994. I’ve been a customer of theirs since 1996, that’s 23 years ago. You can’t pay with cash. I got my first credit card in 1983. From my point of view death of cash has been a long time coming. However, a review by the Bank of England in March found that 8 million adults would struggle to cope without cash. They are looking into how to keep cash alive. But business is business, and banks have to compete with online only operations.

Currently only 30% of UK transactions use cash. In Sweden cash usage is down to 15%. Half of Swedes use a payment app called Swish. That means they’re all using good quality smartphones with good mobile contracts. Next down the list for being almost cashless is China. This also has huge implications for retailers as shown in the 12 min video below.

The online world moves really fast. Young women in China are watching others who are live streaming video of themselves modelling clothes. Viewers can click and buy right there, in the app, on their phone. There’s a lot of hustling, a lot of fun, and the price has got to be good because it cuts out the wholesaler and the retailer! Over here Mike Ashley has bought House of Fraser and apparently lost £150 million trying to take over Debenhams. He has a lot of money invested in high street stores. I wonder if he’s seen this:

For the people who are uncomfortable with the switch to digital and cashless I can only urge them to make a start. None of us learnt this stuff overnight, but in small steps.

Tesco run their own bank, and your debit card doubles as your points card. Today I asked at the counter in Gladstone Place if it was possible to open a bank account instore. You can’t – it’s only online. Some of those eight million people will have to rely on friends and relatives to get them started. All these pieces live together. You can’t buy online without a means to make payments. Credit cards are good as they act as a buffer between your bank account and the transaction. To go mainstream cashless all people need is a credit card. It’s very easy to use online banking to pay it off each month.

Younger people do everything on their smartphones, including making payments. Older folk – that’s me – prefer tablets because they are larger and easier to read.

Here’s my recipe for getting started

You don’t need a laptop anymore – go for a tablet. John Lewis are currently offering a Samsung 10″ tablet with 32 gigs of memory and 2 gigs of RAM for £159. You’d probably get 3/4 years out of this before it goes out of date.

Take Google’s shilling and setup a Gmail email account. This also comes with a Google Drive for cloud storage, a calendar, and Google Docs, which is a bit like Microsoft Word. Use YouTube to watch videos. All of this is free and works well with their Chrome web browser. For help about anything type How do I … into Chrome or YouTube. This Google setup works on both iPhones/iPads and Android. It syncs automatically across everything you use. The photo below shows a Microsoft bluetooth keyboard linked up to my Apple iPad to type a Google Doc.

To go digital people need broadband (wifi) at home. I’m using Vodafone without any problems and am paying £23 a month. This is a lot safer than using free public wifi, and I wouldn’t advise using the Idea Store computers for your online banking. This basic, but well usable setup, will average out at about £1 a day. Once people gain experience and confidence they’ll be saving more than that by buying online.

I’d advise anybody getting started just to take it one step at a time. They need to get comfortable using a tablet to send emails, look stuff up, and of course read newspapers. The Evening Standard App is free and is a replica of the printed version. They make their money from the adverts. You have to enlarge it by spreading your fingers apart to read it. The Express have two apps, one is free but limited, whereas the red coloured one costs £7 a month and works like the Standard. The Daily Mail is free. I like the free Sky News app which is middle of the road, and updates throughout the day. The Guardian is free, but they’ll pester you to subscribe or donate. The Telegraph and the Times both offer the full broadsheet in a sophisticated app. You can change size of the text, click on links, and watch videos in it. These two cost £26 a month each, which is half the shop price. The publishers make more profit from digital because they don’t have to print, deliver or give the retailer a cut. Reading newspapers on a tablet instead of buying them will make owning a tablet cost neutral.

There are many more newspapers and online magazines you can read, including international versions (in English) from many parts of the world. There are all sorts of TV news channels, which since they are not broadcast to you, don’t require a licence. The Sky News app, for instance has videos in it which might have been recorded as late as an hour ago, but don’t require a TV licence.

Channel hopping on YouTube is much more fun, and less dopey than broadcast TV.

Ray,

That’s a valid point you make. Under the heading it says Alan T – that’s me, Alan Tucker. I strongly stand by this article.

I’ve been reading articles about this for several years. Here’s a very recent one called “UK Cash System Close to Collapsing” https://www.moneyexpert.com/consumer-spending/uk-cash-system-close-collapsing/

The Sainsbury’s Store at Holborn Circus, that I mentioned not only doesn’t accept cash, it doesn’t have tills either. The trial runs to the end of July, when they’ll see how they’ve got on. Sainsbury’s said that 82% of transactions there were already cashless. That sounds like beyond tipping point to me.

I published this to try to get people to start making the shift to doing things differently. It’s not simply that cash is becoming more difficult to use. There are many things that are only available to purchase online, and most things are cheaper if you buy online – which means you can’t use cash. Simple things like train tickets are cheaper online. If you fish around, play with the options, and book two weeks in advance you can save a lot of money: http://ojp.nationalrail.co.uk/service/planjourney/search

In 2017 cash was only used for 40% of payments in the UK. In 2026 cash is predicted to be used in only 21% of transactions.

There’s a lot of first person comment but no name on the article. Presumably written by someone already ashamed of their own argument.