Closed bank branches and vanishing cash machines are of concern, especially to older people. But action is now being taken to maintain the ability to withdraw cash.

The background to payment by card

In June 1966 Barclays launched the first British credit card, branded as Visa. It introduced the first ATM (automated teller machine) a year later in Enfield.

In 1966 credit cards were regarded as an alien American import. Barclays, being good at marketing, sent out a million cards to existing customers. Midland Bank launched Access in 1972 and within 6 months had two million cardholders.

Magnetic strips and Pin numbers followed. Barclaycard introduced the first UK contactless cards in the UK in 2007.

Between 2008 and 2018 the number of transactions involving cash halved.

Disappearing banks and ATMs

Since Jan 2018 1,200 bank branches have closed, and at the end of last year 8,700 free ATM cash machines had gone. Cash machines cost money to run and the banks pay 22.5p each time you withdraw cash to the ATM operator. They are not paying enough for the operators to keep going. Once the lockdown started ATM usage fell by 62%. In the week following 17th March 2020 UK cash usage halved. Coins are well-known carriers of dirt and bacteria.

Bank branches are closing because the banks are not making enough money to cover the costs. That’s why they want everybody to bank online. Why aren’t the banks making money? – zero interest rates. Retail banks hold massive amounts of customers cash which they used to be able to earn interest on. With interest rates near zero it costs them money to run your account. Maybe some will stop retail banking, or charge you fees to run your account. Schroders report that with the Eurozone offering negative interest rates, German savers are paying “depositary charges” for the banks to hold their money for them.

Central banks are setting zero or negative interest rates to stimulate economic activity. Cheap borrowing will incentivise businesses to expand or innovate. Rishi Sunak is taking advantage of this. The Bank of England has set our interest rate at 0.1%. Last week the US Federal Reserve said that their interest rate will remain at near zero until 2023.

Banks to fund ATM machines to keep high streets alive

At the end of August I read that the UKs main banks and building societies will provide funding to ensure the survival of free to use cash machines. Critics argue that the scheme will be unable to cover everywhere. The funding might might only stretch to keeping 1/3 of the current ATMs going. That will be OK in a densely populated urban area like Bow. Walking from the Roman Road Market to the top of Brick Lane I found plenty of cash machines offering free withdrawals. The main concern is small towns and villages that already have no banks, Post Offices, or cash machines.

A survey for Link (the cash machine network) found that 17% of the population was not yet prepared for a cashless society. Currently around 10% of the UK’s shopping centres are without free to use cash machines.

Shared bank branches on the way

The Post Office is to start operating shared bank branches in empty shops. The idea is that managers from different banks will come in on different days to offer counter services. The example given was that, say, Lloyds could come in on Monday, HSBC on Tuesday etc.

Twenty eight banks already pay the Post Office to allow their customers to withdraw and deposit cash. Customers complain about queues and lack of privacy.

Shops to offer free cash withdrawals in new trial

On October 14th in just 15 shops, a test run will begin to offer free cash withdrawals from tills without the need to make a purchase. The trail is being run by Link in conjunction with PayPoint.

What will happen next?

At some point cash will disappear. It’s demise is being accelerated by Covid -19. We’ve already passed the point when practically everything is cheaper and more convenient online. Locally it looks like you’ll be able to withdraw cash OK, but not always be able to spend it. Some businesses are refusing to take cash. Anything you order online or through a phone app is cashless.

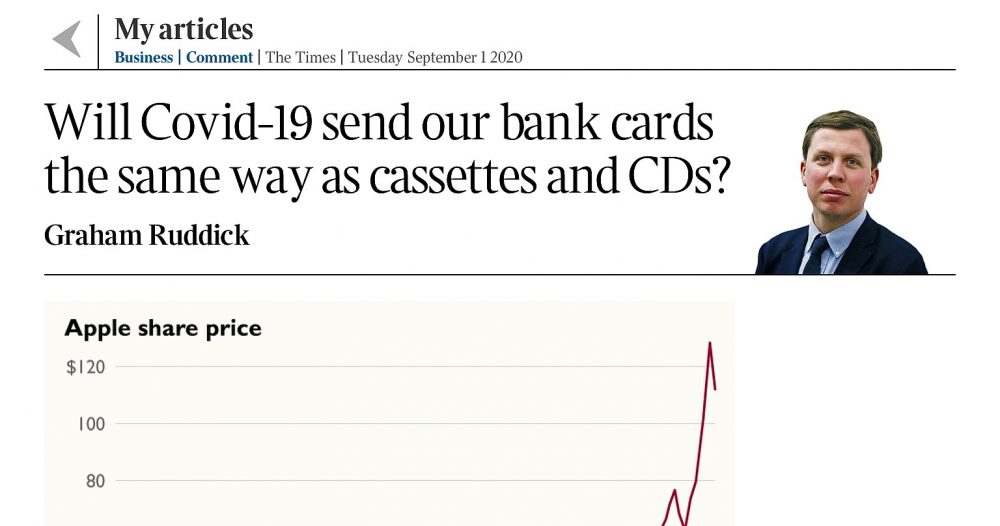

The article above in the Times started with a graph showing the rise of the Apple share price. It trebled over the last two years. This isn’t because it’s just launched a new innovative iPhone/tablet/computer. It’s risen because it is moving towards new areas – banking and TV.

At the governments recent shambolic tightening of coronavirus restrictions they first announced that pubs would be table service only, before hurriedly backtracking. Take that as a warning. The Wetherspoons app works like a dream. If you’ve already got your phone in your hand to order, it’s only a couple of taps to pay using Apple Pay or Google Pay. Phones are now becoming essential parts of everybody’s life. You can rent a Zipcar off the street and unlock it using the app on your phone. Or buy cheaper national train travel, then use your phone to show your ticket. The uses are endless, convenient, and often the cheaper option.

Graham Ruddick’s article in the Times says that Silicone Valley giants might blow away some of our old familiar banks.

Virtual Currencies

I must have been using PayPal for about 15 years to buy online. Quite a number of those transactions involved stuff coming from abroad. PayPal seamlessly converted currencies without ripping me off. I never even noticed it, because it converted the currency then displayed the price in pounds to me before I bought. So what would happen if there was a PayPal $, or Apple or Google set up their own currency?

You may remember that Facebook was working on launching its own currency called Libra. It encountered “regulatory pushback”. The world’s Central Banks must be terrified of losing control. In April the New York Times said that the Libra Association, which is based in Switzerland, was still working on getting regulatory approval. The article said: “To ensure that authorities around the world are on board, the Swiss agency is working with a ‘college’ of regulators from over 20 countries. The association said it still aimed to bring the system live this year.”

In a speech given by Christina Segal-Knowles of the Bank of England in June she lists three private sector proposals for new ways to pay:

- Unbacked Crypto-Assets, such as the volatile Bitcoin

- Stablecoin which is pegged to a single, or basket of currencies (Libra)

- Reserve backed stablecoins which are linked to a single currency and backed by Central Bank Reserves.

No physical coins or currency would be issued in the three examples above. About 40 of the Central Banks in the world are already looking into this. There’s a lot of discussion online. Any moment soon the dam will burst.

In May 2019 I wrote about The End of Paying by Cash.

Alan Tucker

MIT Technology Review wrote about the idea of cash as a potential vector in March; the takeaway being that

‘… focusing on money misses a more important point: “Are you in a crowded theater? Are you in a restaurant? Are you in a Costco? You’re more likely to pick up Covid-19 from people exposure than from the type of payment.”’

Neither has there been any any evidence to date of it being directly involved as a vector in any single case of infection. By that metric the PIN pad at the supermarkets would be a far more concentrated source, and as unlikely to be cleaned as well.

Besides, for every eatery that’s switched over to cashless you should expect massive resistance from barbers, hairdressers and nail salons- all who essentially run a cash-based business.

Its almost unheard of to find a standard gents barber that takes card, likewise with ladies stylists where you’d easily part with £150 cash in a single session. In fact any place that hires chairs is probably a cash-only outfit and they make it their business to ensure a machine is nearby.

It’s long been a dream of government to eliminate cash – as much a control over errant citizenry as a ways to ensure more honest taxation. I’ve no problem with this – too many ‘cash only’ places plead poverty when talk of using card machines comes up, while playing musical chairs with HMRC. But not at the expense of the senior who doesn’t need – or want – that Android phone their son or daughter has ‘showed them a thousand times how to use’.

I worked fot the company that fitted the first cash machine , The company was De La Rue , And the machine was called a DACS , . ,Which I believe stood for De La Rue automatic cash system , I was not involved in the installation , and i believe Reg Varney was rthe first customer , They would only dispense £10 in those days

Bill, thanks for writing in. That’s fascinating.